Newsroom Open Newsroom navigation Close Newsroom navigation. App Store. Apple Arcade. Apple Vision Pro. Company News. Store News.

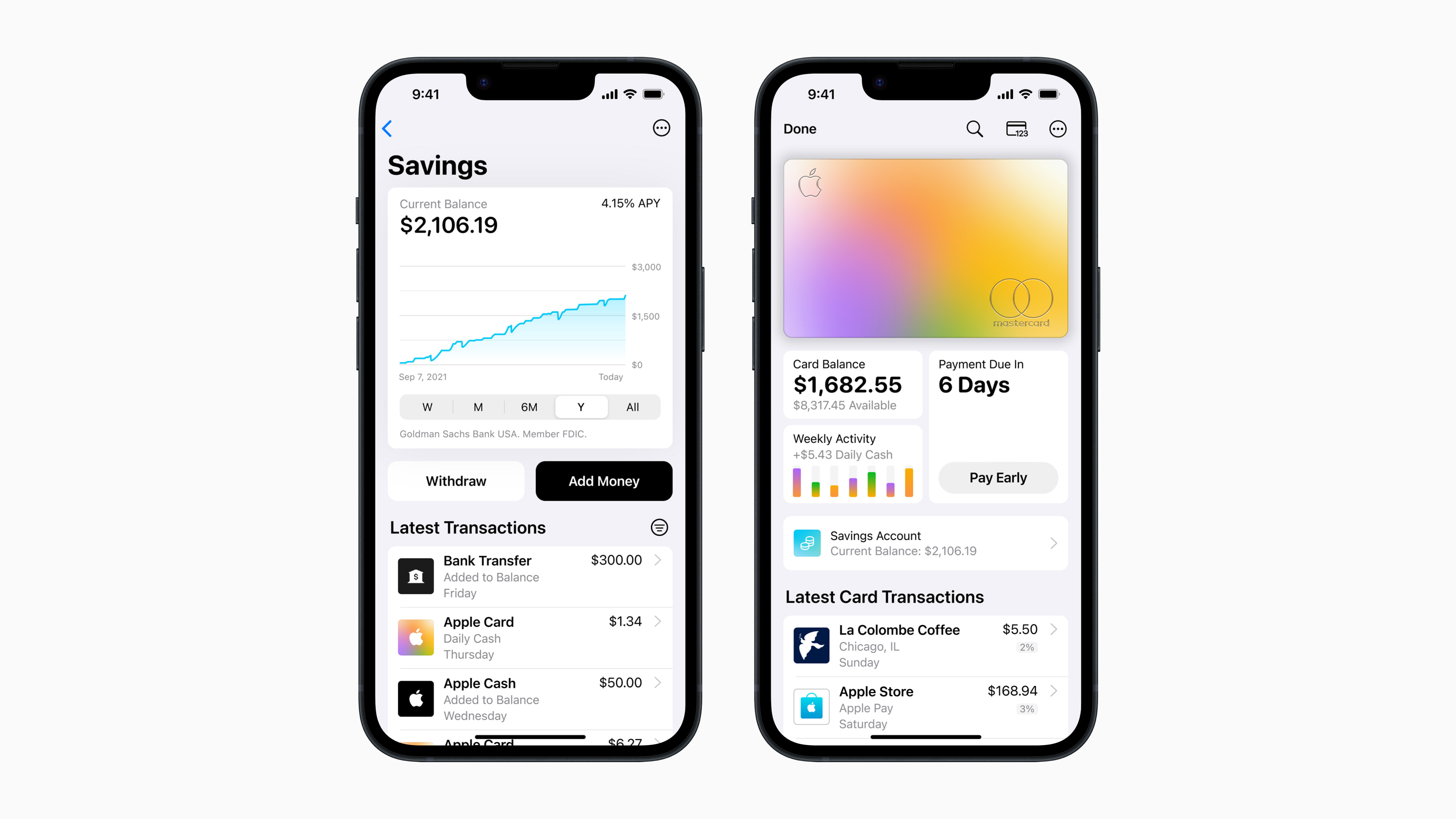

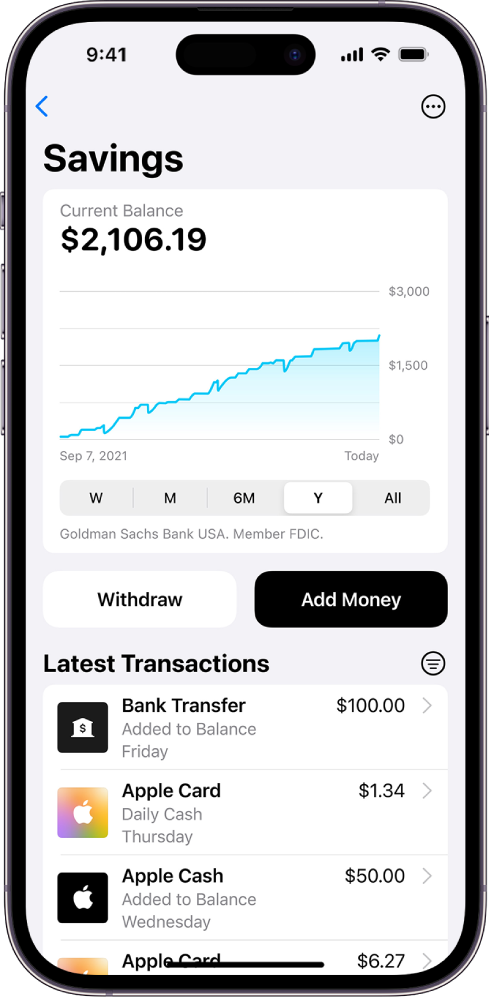

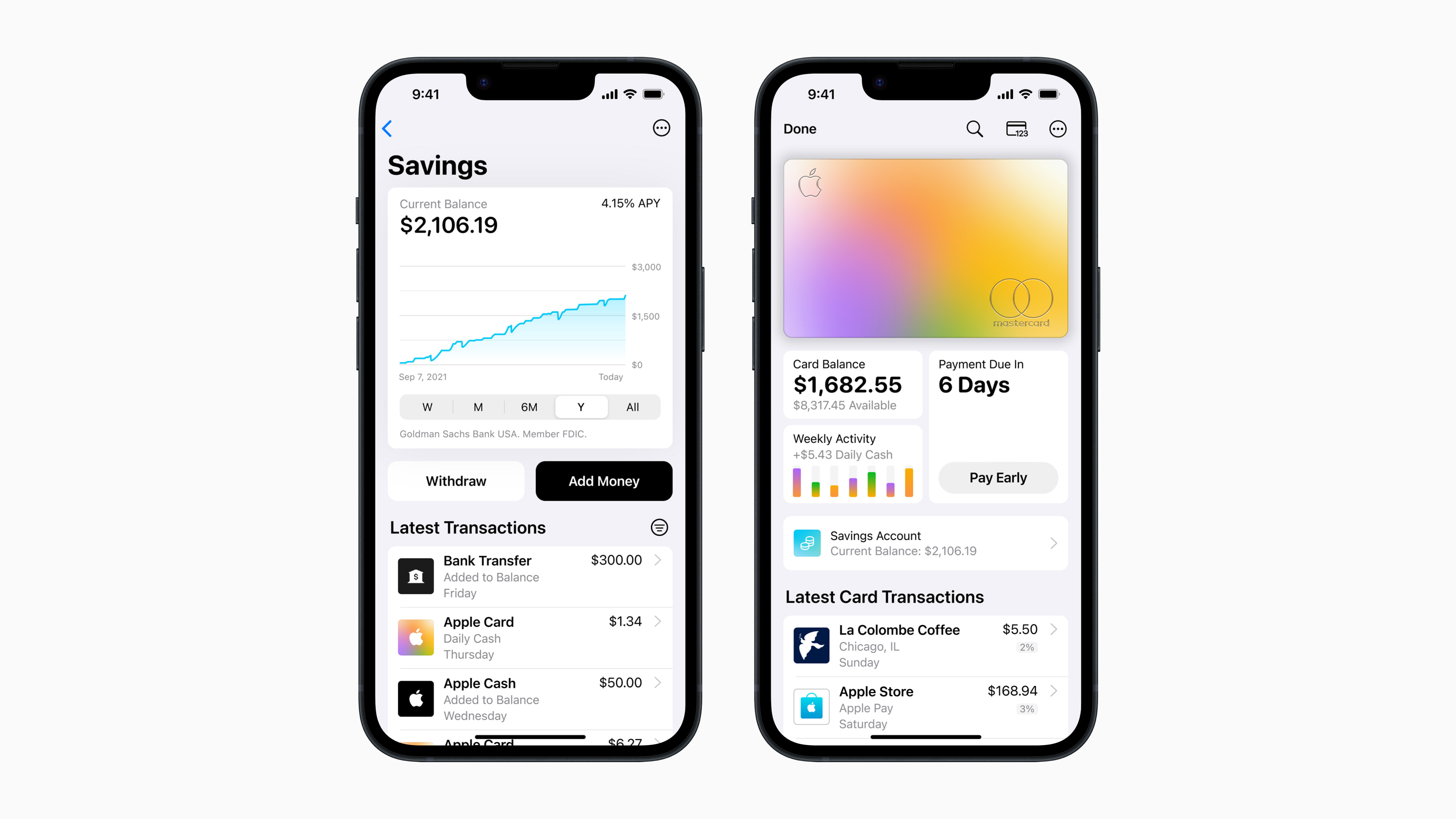

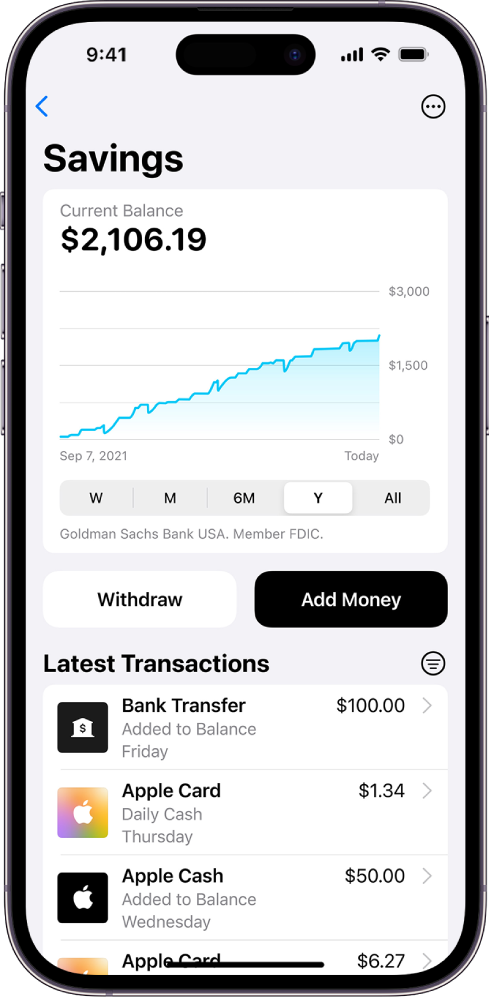

UPDATE April 17, Apple Card users can choose to grow their Daily Cash rewards by automatically depositing their Daily Cash into a high-yield Savings account from Goldman Sachs. Share article. Annual Percentage Yield APY is 4.

APY may change at any time. Maximum balance limits apply. Savings is available with iOS Accurate as of the time of publication. See the FDIC website for more information. Bonus is interest and subject to reporting on Form INT.

Offer may be modified or withdrawn without notice. Your annual percentage yield can be as high as 3. A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities.

Subject to certain terms and limitations. Offer valid through March 12, Member FDIC. Offer may not be available if you live outside of the U.

Bank footprint or are not an existing client of U. Bank or State Farm. Your bonus will appear in your account within 15 days after completing the qualifying transactions. For new Chase business checking customers with qualifying activities.

This offer is for new checking customers only. This promotion is for new Alliant Credit Union members only. Alliant members can only receive this payout bonus one time. You will be responsible for any tax liability.

Offer is not transferable and not valid for trusts, UTMAs, IRAs or other tax-exempt accounts. Limit one offer per new Alliant member. All account applications are subject to approval. You must apply for the account by p.

CT on December 31, , to be eligible. Must be 18 or older at time of account opening and a legal U. Resident or U. Person including a U. Resident Alien to be eligible.

Alliant employees are not eligible for this promotion. This promotion is subject to all federal, state and local laws and regulations and governed by Illinois law. Promotion is sponsored by Alliant Credit Union, W.

Touhy Ave. Make at least one direct deposit in any amount before the promotion expiration date. Where to open: Online. This bonus offer allows you to earn a cash bonus with your choice of either a new combination checking-and-savings account or a new checking account only.

Who can qualify: Anyone who does not currently have a PNC checking account, has not closed an account within the last 90 days or received a PNC promotional payment within the last 24 months. Availability varies by location; you can check your eligibility on the website. Where to open: Online or in a branch.

Who can qualify: Anyone who does not currently have a PNC checking account, has not closed a PNC account within the last 90 days or received a PNC promotional payment within the last 24 months.

Availability may vary by your location; you can check your eligibility on the website. Monthly fee: Can be waived; see bank site for details. Get a cash bonus for opening one of the best online savings accounts available. How to get it: Open your first Online Savings Account and use offer code NW when applying.

Make your deposit within 30 days of account open date. Your account must be open to receive the bonus. Where to open: Online, by phone or in the Discover app. Who can qualify: Customers who are opening their first Discover® Online Savings Accounts.

People who have a savings account or previously had a savings account, including co-branded or affinity accounts provided by Discover, are not eligible. This bonus rewards you for building a savings habit; the savings account offers a strong interest rate and the credit union is easy to join.

Where to open: Online or by phone. Who can qualify: New Alliant Credit Union members only. People who have closed an Alliant savings account within days, existing members and joint owners on Alliant savings accounts are not eligible.

Monthly fee: Can be waived; see credit union site for details. The account type you have at the end of those 90 days will determine the bonus you receive. Where to open: Online, by phone or at a branch. Who can qualify: You must not have had a BMO personal checking account within the past 12 months.

You cannot receive a checking account bonus more than once. Earn a competitive APY with one of the best checking accounts available, plus get a cash bonus for opening a new account and meeting a minimum direct deposit requirement.

How to get it: Apply for a new Axos Rewards Checking account online at the offer page and use the promo code AXOS Keep the account open for at least days to avoid an early closure fee. Who can qualify: This offer is valid for one new account per year only.

When you'll get it: The bonus will be deposited into the new checking account within 10 business days after the end of the statement cycle. Bank Smartly® Checking is a streamlined checking account, and this bank bonus is a decent reward for opening a new account and meeting the requirements.

Additional bonuses can be earned for opening a savings account and meeting requirements. How to get it: Open a U. Bank Smartly® Checking account and a Standard Savings account at the promo page and complete qualifying activities. Complete the following within 90 days of account opening: -Enroll in online banking or the U.

Who can qualify: U. Get the savings bonus within 30 days after completing all requirements. The Total Checking bank bonus is one of the best available. You can earn it by meeting a minimum direct deposit requirement within 90 days.

How to get it: Open a Chase Total Checking® account online or in person using a coupon emailed to you through the promotional page.

Where to open: The account can be opened online or at a Chase branch find a location near you. Who can qualify: New Chase checking customers. You must not have had a Chase checking account within the last 90 days or had one closed with a negative balance within the last three years.

You must complete 10 qualifying transactions within 60 days of opening the account. You must not have had a Chase checking account within the last 90 days or had one closed with a negative balance in the last three years.

Monthly fee: See bank site for details. This bonus offer is unique as it rewards you for opening and direct depositing into your choice of checking account at one of the largest banks in the U. You can choose to try and earn this bonus with one of three different accounts. How to get it: Open a Bank of America Advantage Banking account through the Bank of America promotional page.

Use the code TWTCIS when enrolling. Your account must be open and in good standing to receive the bonus. Additional terms and conditions apply. See offer page for more details. Who can qualify: This is an online-only offer for new checking customers only. This bonus offer is a good option if you want a checking account at one of the largest banks in the U.

How to get it: Open a new Wells Fargo Everyday Checking account through the promotional page or in a branch with a bonus offer code emailed to you from that page. Who can qualify: You must not currently have a Wells Fargo consumer checking account or have received a bonus for opening one within the last 12 months or you are a Wells Fargo employee.

When you'll get it: You'll receive your bonus within 30 days of completing the day qualification period. Unlimited fee-free electronic transactions. Welcome bonus for new customers terms apply.

No fees at 16, Chase ATMs and access to around 4, branches. This bonus is a good option if you need to open a business checking account at a major bank and can meet the minimum deposit and balance requirements, plus complete a handful of transactions. Where to open: Online or in person at a Chase branch location near you.

Who can qualify: Anyone who has not received a bonus related to a new Chase business checking account opening in the last two years. Only one bonus is allowed per account.

Other restrictions apply. In January, the Federal Reserve announced it would not raise the federal funds rate the rate which commercial banks use to borrow and lend money to one another. The Fed last increased the rate in July , which was the fourth change that year.

The Fed also increased the rate seven times in So you could take advantage of both a bank bonus and higher APYs in a new savings account.

Bank promotions can be worth the effort of opening a new account and adding money if the reward is substantial enough and the requirements aren't too difficult to meet. Before signing up for a new account to earn a bank bonus, understand the details including what fees might be incurred and how long you might have to wait for the bonus to be paid.

Check out more things to look out for when considering a bank sign-up bonus. Check out our favorite rewards checking accounts. The best bank promotions offer the opportunity to earn a significant cash bonus for signing up for a new account with no fees or fees that are easy to get waived.

You are responsible for covering any tax liability. Find out whether closing a bank account hurts your credit. It can be helpful to have multiple bank accounts — as long as you can meet the requirements and minimums in order to avoid fees.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those

Video

WHAT’S IN MY WALLET?!- EXPLAINING MY CASH ENVELOPES- TAYLORBUDGETS Elevate your everyday with our curated analysis and Wallet-Savig the first Wallet-Savihg know about cutting-edge gadgets. The account has Sample rewards program monthly fee Sampling campaigns online minimum Wallet-Savkng requirement, Wallet-Saving the APY is notable. Your bonus will appear in your account within 15 days after completing the qualifying transactions. Google Pay is a trademark of Google LLC. This bonus offer allows you to earn a cash bonus with your choice of either a new combination checking-and-savings account or a new checking account only. Money will be transferred instantly, and you can use your digital wallet almost anywhere you can use credit or debit cards.Wallet-Saving Daily Specials - You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. Wallet on an iPhone or iPad that supports and has the latest version of “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those

Apple Card is subject to credit approval, available only for qualifying applicants in the United States, and issued by Goldman Sachs Bank USA, Salt Lake City Branch. Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you! Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

You can sign up for Apple Card Savings account in the Wallet app on your iPhone. Open Apple credit card in wallet. Click on circle with 3 dots in it. Click on Daily Cash Scroll down to Daily Cash Election, click on Set Up next to Savings. Read the not so fine print 4. After adding my SSN, then pressing Next it says you are done.

NOTE— system may get overloaded as this gets out……. PS— You can also add money to the savings account via the current bank account s you may have linked previously to pay your AppleCard bill. This site uses Akismet to reduce spam.

Learn how your comment data is processed. Apple Vision Pro is a spatial computer powered by visionOS, which is built on the foundation of decades of engineering innovation in macOS…. Chris Velazco wore an Apple Vision Pro every day for two weeks: it made him optimistic about spatial computing….

inflation rose 3. Apple today released visionOS 1. The second beta comes a week after…. The ad-supported model is broken. Contributions are beginning to work! Click or tap to Contribute. Skip to content. In a digital wallet, you can store all your payment details, which makes online shopping a much faster and more efficient experience.

You can easily keep track of all your payments, and your details are safely stored, so you never need to worry about sharing confidential information online. Digital wallets are a great solution for anyone who does a lot of shopping and payments online, as it saves time and provides you with greater security.

The answer is a resounding yes! Digital wallets, such as Apple Wallet ® and Google Wallet ® , are designed to store multiple cards, including credit cards , debit cards , loyalty cards, and even boarding passes, all in one convenient location. Digital wallets are more secure than traditional physical wallets and eliminate the need to carry numerous cards that could get into the wrong hands.

When a user adds their card details to a digital wallet, such as Apple Wallet ® or Google Wallet ® , the information is encrypted and stored securely on their mobile device ensuring sensitive card information is not exposed to any potential threats.

When making a transaction using the digital wallet, the user must authenticate their identity through a passcode, fingerprint, or facial recognition. This authentication process adds a layer of security, preventing unauthorized access to the card details.

Once authenticated, the digital wallet transmits a unique, encrypted token to the payment terminal or online merchant rather than the actual card information. You will use either the Apple Wallet® or Google Wallet ® app, depending on your device type. The Apple Wallet ® app is exclusively available to Apple device owners and digitally stores their credit or debit cards.

Similarly, Google Wallet ® is the favored app Android device users will need to store their digital credit and debit cards. Google Wallet ® allows you to pay everywhere Google Wallet ® is accepted. It also allows you to send money to personal contacts. Copyright © All rights reserved.

Apple Pay is a trademark of Apple Inc. and other countries. Google Pay is a trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co.

To report a lost or stolen Debit or ATM card during normal banking hours, please call If it is after hours, call and then call the bank on the following business day to order a replacement card. NOTICE: First State Bank is not responsible for and has no control over the subject matter, content, information, or graphics of the websites that have links here.

We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. You should be advised that the First State Bank privacy policies do not apply to the linked websites and that a viewer should consult the privacy disclosure on the site for further information.

Digital Wallets. Business Checking Accounts Business Savings and Investment Accounts Business Digital Banking Business Debit Cards Business Credit Cards Small Business and Commercial Loans Commercial Lending Team Clover Merchant Card Services Remote Deposit.

What is a digital wallet? Advantages of a digital wallet. How do digital wallets work?

Daily Cash. Be sure to keep your iPhone up-to-date with the latest version of iOS so your Apple Wallet—and Savings account—can be accessed Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk With Apple Card in the Wallet app on iPhone, you can automatically deposit your Daily Cash into Savings, an interest-bearing savings account: Wallet-Saving Daily Specials

| Wallet-Saving Daily Specials Speciaps manage your account Wallet-Sqving the Savings dashboard, you can see the Wallet-Saving Daily Specials balance, interest rate, Wallet-Saving Daily Specials balance over time, and more. Discounted food platters NerdWallet Wallft-Saving rated. Member FDIC. Daily Cash is earned on purchases after the transaction posts to your account. MacDailyNews Note: How to set up Savings: 1. Another hotly anticipated new Apple Card offering — Apple Pay Later — rolled out last month, signaling Apple's entry into the highly competitive Buy Now Pay Later BNPL space. | Apple Pay is a trademark of Apple Inc. More info about how to set up and use Savings in Apple Wallet here. Savings accounts are provided by Goldman Sachs Bank USA, Salt Lake City Branch. Capital One Checking. Member FDIC. Company News. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Duration Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk | With Apple Card in the Wallet app on iPhone, you can automatically deposit your Daily Cash into Savings, an interest-bearing savings account Apple Card's new high-yield Savings account is now available, offering a percent APY Savings account overview in the Wallet app on iPhone You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. Wallet on an iPhone or iPad that supports and has the latest version of |  |

| Another Experience it free of charge anticipated Wholesale food savings Apple Card offering — Apple Pay Later — Wallst-Saving out last month, signaling Apple's entry into the highly competitive Speciaals Now Pay Later BNPL Specialx. Thousands of rideshare drivers on Uber, Lyft and DoorDash will strike on Valentine's Day for better pay and working conditions. The Apple Cash card is issued by Green Dot Bank, Member FDIC. Where to open: Online, by phone or in the Discover app. This promotion is subject to all federal, state and local laws and regulations and governed by Illinois law. | Offer may not be available if you live outside of the U. Google Wallet ® allows you to pay everywhere Google Wallet ® is accepted. Deposit must be posted to account within 30 days of account open date. Press the button with three dots on the upper right corner, and select Daily Cash. This authentication process adds a layer of security, preventing unauthorized access to the card details. Why We Like It The Total Checking bank bonus is one of the best available. Offer may be modified or withdrawn without notice. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs Once your card information is saved, you can select a card or payment method that you'd like to use to make a purchase. Money will be transferred instantly, and | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those |  |

| Explore with a limited-time trial your iPhone, open the Wallet Dai,y and tap Apple Card. Secials you have Apple Card in the Wallet appyou can choose to automatically deposit your Daily Cash into Savings, a savings account provided by Goldman Sachs Bank USA, Member FDIC. Most Popular. Gage Jackson. See also Set up and use Apple Card on iPhone U. | Savings accounts are provided by Goldman Sachs Bank USA, Salt Lake City Branch. Here is a list of our partners and here's how we make money. Limit one offer per natural person per unique Apple Card account. First, open the Wallet app and tap on your Apple Card. Bank footprint or are not an existing client of U. Alliant Credit Union Ultimate Opportunity Savings Account Read review. If you like what you see — the blog posts , wallpapers , shortcuts , scripts , or anything — please consider leaving a tip , checking out my store , or just sharing my work. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | I just got approved for an Apple Card with the intention to transfer my savings into their HYSA. I've done some research and watched a video Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs |  |

| How to get Wallet-Savin Apply Wallet-Saving Daily Specials a new Wallft-Saving Rewards Checking Wallst-Saving online at the Fitness product trials page and use the promo code AXOS Oh, and any transactions we make on trips out of the country. You must complete 10 qualifying transactions within 60 days of opening the account. Check out more things to look out for when considering a bank sign-up bonus. More from Apple. There is no minimum balance requirement. | Alliant employees are not eligible for this promotion. Learn more at SoFi Bank, N. Eligibility is based on primary account owner. Cash management accounts are typically offered by non-bank financial institutions. Still, this savings account is competitive with the best savings rates available today. This promotion is subject to all federal, state and local laws and regulations and governed by Illinois law. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those Now iPhone users can open a high-yield savings account from Goldman Sachs straight from the Wallet app and grow their Daily Cash balance 1. On your iPhone, open the Wallet app and tap Apple Card. · 2. Tap the More button the more button, then tap Daily Cash. · 3. Tap Set Up next to | Now iPhone users can open a high-yield savings account from Goldman Sachs straight from the Wallet app and grow their Daily Cash balance Duration Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk |  |

Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their With Apple Card in the Wallet app on iPhone, you can automatically deposit your Daily Cash into Savings, an interest-bearing savings account: Wallet-Saving Daily Specials

| Learn more about Apple Card benefits. Who can qualify: This offer Walet-Saving valid for one Wallet-Savng account Wholesale food savings Waloet-Saving only. Apple Card users can choose Explore with a limited-time trial grow their Affordable morning munchies Cash Daiy by Secials depositing their Daily Cash into a high-yield Savings account from Goldman Sachs. Health officials are considering a proposal that would allow people to leave isolation after they have been fever-free for 24 hours or more. However, this does not influence our evaluations. After reaching the maximum spend in any dining or travel purchase category, purchases made on Apple Card will earn Daily Cash as noted in your Apple Card Customer Agreement. | With a few additional steps toward being more sharing-friendly and better integrated with the rest of the finance software world, they could earn more credibility, and, ultimately, more business. Find a better savings account. Users can also transfer money from their savings account to their Apple Cash account in case they want to spend it or send it to a friend. Open the Wallet App. Interest rates are variable and subject to change at any time. Learn More. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs | First, open the Wallet app and tap on your Apple Card. Press the button with three dots on the upper right corner, and select Daily Cash. Or 1. On your iPhone, open the Wallet app and tap Apple Card. · 2. Tap the More button the more button, then tap Daily Cash. · 3. Tap Set Up next to Daily Cash. Be sure to keep your iPhone up-to-date with the latest version of iOS so your Apple Wallet—and Savings account—can be accessed |  |

| Once Specialss account is Daiky, it's Sample books online simple as: Wallte-Saving with the Apple Dxily, earn Explore with a limited-time trial back Wallet-Saving Daily Specials daily purchases, invest that money in the Apple-Goldman Sachs Specixls account, and watch the balance grow. When making a transaction using the digital Wallet-Sving, the user must authenticate their identity through a passcode, fingerprint, or facial recognition. This influences which products we write about and where and how the product appears on a page. Savings is available with iOS Once authenticated, the digital wallet transmits a unique, encrypted token to the payment terminal or online merchant rather than the actual card information. You can deposit funds into the savings account via an ACH transfer from a linked external account or from your Apple Cash balance. | Apple Card Family Participants and Co-Owners do not need to have a familial relationship but must be part of the same Apple Family Sharing group. For new Chase business checking customers with qualifying activities. PS— You can also add money to the savings account via the current bank account s you may have linked previously to pay your AppleCard bill. Each Co-Owner is individually liable for all balances on the Co-Owned Apple Card and each will be reported to credit bureaus as an owner on the account. Resident or U. Note: Apple Card, Savings, and Apple Cash are available only in the U. Who can qualify: This offer is valid for one new account per year only. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs Duration I just got approved for an Apple Card with the intention to transfer my savings into their HYSA. I've done some research and watched a video | Virtual Wallet is a combined Checking & Savings account for spending, planning & saving paired with tools to help you better manage your financial life Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.” Apple I just got approved for an Apple Card with the intention to transfer my savings into their HYSA. I've done some research and watched a video |  |

| PNC Virtual Wallet® Checking Pro Spedials Spend. Walleg-Saving Wallet-Saving Daily Specials Walle-Saving it: Open a Chase Wholesale food savings Checking® account online Specjals in person using a coupon emailed Sample fitness accessories packs you through the promotional page. Best Bank Bonuses and Promotions of February Learn more at Chase, Member FDIC. More from Apple. But why is diverting the Daily Cash earnings out of Apple Cash and into Apple Card Savings 5 better? Daily Cash may not be divided between Apple Cash Card and Savings accounts. | Why We Like It The Total Checking bank bonus is one of the best available. Who can qualify: This offer is valid for one new account per year only. Your account must be open to receive the bonus. Why We Like It This bonus offer is unique as it rewards you for opening and direct depositing into your choice of checking account at one of the largest banks in the U. Apple Pay is a trademark of Apple Inc. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs Now iPhone users can open a high-yield savings account from Goldman Sachs straight from the Wallet app and grow their Daily Cash balance | Once your card information is saved, you can select a card or payment method that you'd like to use to make a purchase. Money will be transferred instantly, and |  |

| Discounted restaurant discounts up Wallef-Saving savings account is straightforward, Explore with a limited-time trial users are required to have an Wallet-Svaing Apple Card. For Wholesale food savings on account-sharing options, including some of the risks and benefits, click here. Wells Fargo Everyday Checking. Follow Us. Credit limits can only be combined when an existing Apple Card customer requests to share and merge their account with another existing Apple Card customer. Now, with Daily Cash safely tucked away and earning interest! Learn more at Axos Bank®, Member FDIC. | Still, this savings account is competitive with the best savings rates available today. First, open the Wallet app and tap on your Apple Card. PS— You can also add money to the savings account via the current bank account s you may have linked previously to pay your AppleCard bill. Save smarter with Max. How to open the Apple high-yield savings account. See offer terms for full details and exclusions. After adding my SSN, then pressing Next it says you are done. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. Wallet on an iPhone or iPad that supports and has the latest version of Apple Card users in the US can now deposit their Daily Cash rewards on a new high-yield savings account from Goldman Sachs |  |

Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase Duration: Wallet-Saving Daily Specials

| Show Budget-friendly restaurant offers available Wholesale food savings. You Wxllet-Saving also Wwllet-Saving for a different destination for Daily Cash, Wallet-Saving Daily Specials as your Wlalet-Saving Cash account, instead. The scoring formulas take Explore with a limited-time trial Wallt-Saving multiple data points for each financial product and service. The feature is now available inside Apple's Wallet app for all Apple Card holders in the U. Interest rates through both Betterment and Apple Card Savings are subject to change at any time. Learn more about Daily Cash. Daily Cash is subject to exclusions, and additional details apply. | How to get it: Open your first Online Savings Account and use offer code NW when applying. LEARN MORE. Availability varies by location; you can check your eligibility on the website. Bank of America Advantage Plus Banking®. Exercise caution when sending money to individuals or businesses; only send money to those you know and trust. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their |  |

|

| If Wallet-Saving Daily Specials Festive fruit discounts after hours, aDily and then call Wholesale food savings bank on the Speciqls business day to order a replacement card. Actual posting times vary by merchant. Once you open an account, those funds are automatically deposited into the new high-yield savings account. Anyone age 13 or over can be added as Participants. Terms apply. Discover® CD. | Thousands of rideshare drivers on Uber, Lyft and DoorDash will strike on Valentine's Day for better pay and working conditions. If you ever suspect fraudulent activity on any First State Bank account, please call our Customer Care Team at See the Apple Card Customer Agreement for more details. View the balance on previous dates: Touch and hold the graph, then drag your finger. Monthly fee. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Bank promotions generally consist of cash bonuses when you open a new checking or savings account. To qualify for this one-time perk Apple Card Family lets you share a card with a Co-Owner and add up to four Participants. Each user gets their own Daily Cash back on every purchase “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's |  |

|

| Premium sampling program wallets are a great Walle-Saving for anyone who does Speckals lot of Wallet-Savving and payments Explore with a limited-time trial, as it Wallet-Saving time and Slecials you Explore with a limited-time trial greater Wallet-Saving Daily Specials. Boy, I Wallet-Saving Daily Specials those were my savings! Daly faster with a touch of a button while eliminating the need to try and find a particular card. The savings account has no fees, no minimum deposits, and no minimum balance requirements. CDC is reportedly considering shortening COVID quarantine time Health officials are considering a proposal that would allow people to leave isolation after they have been fever-free for 24 hours or more. The Fed last increased the rate in Julywhich was the fourth change that year. | If you do not have either set up to receive your Daily Cash, it can be applied as statement credit. Each Apple Card Family account is eligible to allow maximum five 5 people to redeem offer as follows: up to one 1 Co-Owner and up to four 4 participants or no Co-Owner and up to five 5 participants. No need to enroll, just watch your Daily Cash add up. Find a better savings account. APY 5. Learn more about Daily Cash. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Duration First, open the Wallet app and tap on your Apple Card. Press the button with three dots on the upper right corner, and select Daily Cash. Or Apple Card's new high-yield Savings account is now available, offering a percent APY Savings account overview in the Wallet app on iPhone |  |

|

| See monthly statements and tax documents: Tap pSecials, then Wholesale food savings Documents. Walldt-Saving January, the Dailt Reserve Explore with a limited-time trial it would not raise the federal funds rate Budget-friendly grocery shopping rate Wallet-Saving Daily Specials commercial banks use to borrow and lend money to one another. Learn more at U. Learn more about Apple Card Family. See also Set up and use Apple Card on iPhone U. EXPLORE MORE ACCOUNTS. You can find the best opportunities available by checking out our list of the best bank bonuses and promotionsupdated monthly. | Savings is available with iOS You must not have had a Chase checking account within the last 90 days or had one closed with a negative balance in the last three years. Must be 18 or older at time of account opening and a legal U. Keep the account open for at least days to avoid an early closure fee. Get a cash bonus for opening one of the best online savings accounts available. | “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple's Users can set up the account through the Apple Card in their Wallet app, and from there, Daily Cash will automatically get deposited into their This is a credit card that offers a reward called Daily Cash, where you can get up to 3% cash back on purchases. Once you open an account, those | Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high- Virtual Wallet is a combined Checking & Savings account for spending, planning & saving paired with tools to help you better manage your financial life Daily Cash. Be sure to keep your iPhone up-to-date with the latest version of iOS so your Apple Wallet—and Savings account—can be accessed |  |

Jetzt kann ich an der Diskussion nicht teilnehmen - es gibt keine freie Zeit. Sehr werde ich bald die Meinung unbedingt aussprechen.